In 2010 a decedent s executor has the option to pay estate taxes subject to the 5 million exemption or opt out of estate taxes all together and instead be subject to the modified income tax basis adjustment rules under irc section 1022.

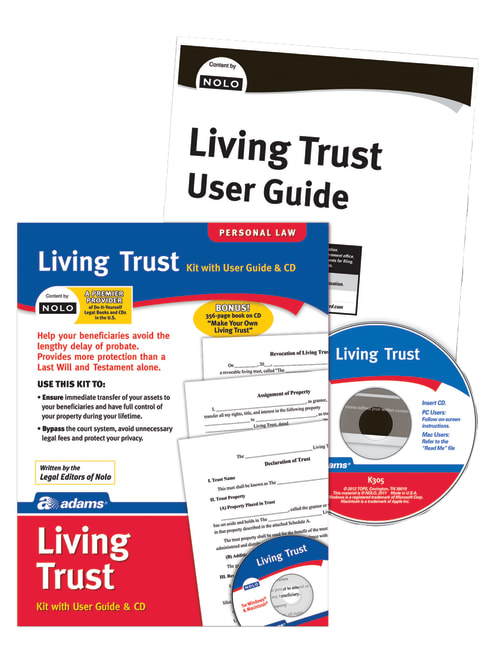

Living trust forms at staples.

Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time.

The california revocable living trust is a document that allows a grantor to specify how his her assets and property should be managed during their lifetime and after their death the assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee person responsible for maintaining the trust however this option is only available with a revocable trust.

Browse living trust forms on sale by desired features or by customer ratings.

The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime.

Valid for use in every state.

Whether you re sending out w2 forms to hourly employees or 1099s to independent contractors preprinted forms from staples make reporting tax information simple.

Compare over 451 total digital legal forms templates with 936 customer reviews and prices from 4 99.

Choose laser or inkjet forms in multipacks for an added level of convenience and select matching envelopes from tops to enhance the professionalism of your business.

Powered by directlaw smart forms technology.

Adams revocable living trust for a single person 1 use interactive digital legal form with fast and free shipping on select orders.

Buy discount digital legal forms templates online.

Are you looking for the best deals and prices on digital legal forms templates at staples.

Adams revocation of living trust 1 use interactive digital legal form 4 5 star average rating.

Unlike a will a trust does not go through the probate process with the court.

A revocable living trust is created by an individual the grantor for the purpose of holding their assets and property and in order to dictate how said assets and property will be distributed upon the grantor s death.

This interactive legal form establishes a revocable living trust for a married couple appointing them both grantor and trustee of property assigned to the trust and eliminating probate costs for a surviving spouse or heir.